End of an Era – From Bitjoin to Indikin

I initially tried to task GPT to help me write this post, but quickly hit significant hurdles given it doesn’t seem to have all the

I initially tried to task GPT to help me write this post, but quickly hit significant hurdles given it doesn’t seem to have all the

Five years ago, I set out to do something unconventional—fuse the world of decentralized finance with the art of filmmaking. At the time, the idea

It’s been a wild first quarter of 2025 for the Indikin team. We launched the Indikin native token $INDI, introduced five filmmaker tokens, and rolled out

What a year! Here’s (almost) everything that happend at Bitjoin Studios in 2024.

An opportunity has been presented by Executive Producer Raymond Hernandez Jr for a professionally produced, well distributed and hopefully soon to be financed crypto documentary

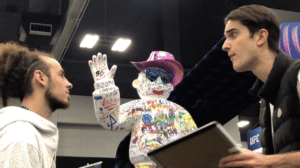

Hey there, Bitjoin fam! Welcome back to another vlog episode I’m your host Rich Tella, benevolent director at Bitjoin Studios and super pumped as a

In this video I highlight some of the latest developments with Bitjoin (which I thought would have been burnt down by now) and I want

Degen Generation: An Interactive Docuseries Experiment Imagine sitting down to watch a captivating docuseries, only to be handed the reins and given the power to